Sponsored Content

Technological Disruptors Are Changing the Medical Testing Industry

How Can Investors Benefit?

HIGHLIGHTS:

- Pre-IPO investors in medical devices have seen great rewards.

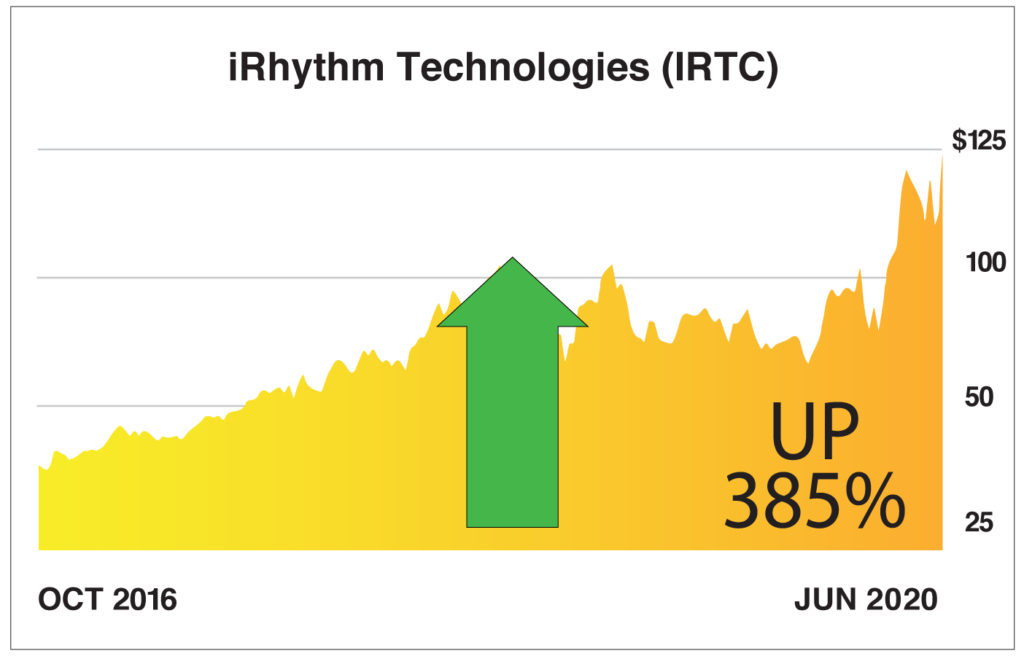

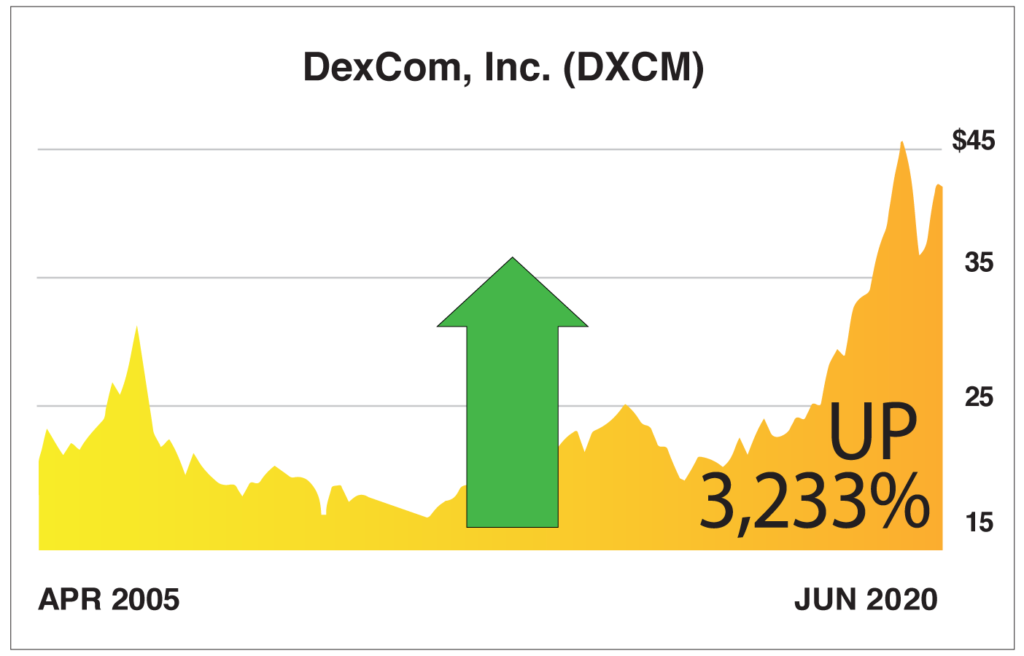

- The 3,288% gain DXCM offered investors.

- How IRTC made investors 385% gains.

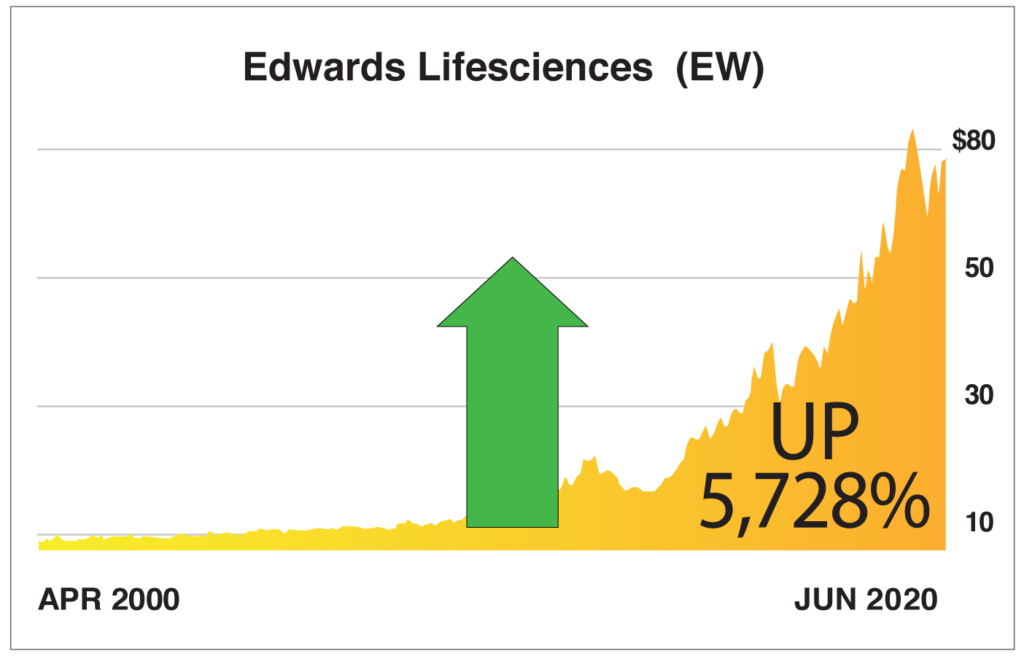

- Why investors in EW saw gains of 5,728%.

- Who’s the next candidate offering ground floor investors a profitable opportunity?

Fill out the form to get the full story.

Rod Reum | 35 year Veteran of Corporate Financing, Structuring, and Governance

Rod Reum | 35 year Veteran of Corporate Financing, Structuring, and Governance

Pre-IPO investors in medical device companies have seen great rewards.

For example …

iRhythm Technologies (IRTC), a maker of heart monitors, went public on October 20, 2016 at $26.75 a share.

Investors who bought 100 shares at the IPO, saw their $2,675 investment grow to $13,000 by June 2020 … for a 385% gain.

Investors who bought 200 shares of DexCom, Inc. (DXCM), a maker of glucose monitoring devices, for $12 when it went public on April 14, 2005, turned $2,400 into $80,000 by June 2020.

Edwards Lifesciences (EW), a maker of cardiac devices, went public on April 3, 2000 at $3.50. Investors who bought 1,000 shares at the IPO, turned a $3,500 stake in to $204,000!

The healthcare testing market is buzzing with activity.

Markedly absent from this busy work is the rush to develop an easy to use, cheap, portable testing device that anyone can use, anywhere, and as often as necessary … in emergency rooms and medical offices … at testing stations and community centers … and most importantly, at home!

Such a device would have unlimited consumer demand, throughout the U.S. and across the globe.

Such a device has the potential to become the biggest in-home testing device on the market, putting investors on the threshold of a market that could be …

- Bigger than sleep apnea devices, projected to be a $12.6 billion market in the next four years.

- Bigger than blood pressure monitors, projected to be a $2 billion market in the next four years.

- Even bigger than blood glucose meters, projected to become a $15.4 billion market by 2026.

Such a testing device can’t hit the market fast enough. And right now, there are too few companies working to make this device a reality.

Fill in the form to get the details.

ABOUT RODNEY REUM

Rodney Reum has 35 years of senior executive leadership of both public and private companies. For longer than 10 years, he has been the CEO of Caballarius Global Holdings, a company specializing in consulting services in corporate financing, structuring, and governance. He has played a key role in management of the financing of many enterprises up to CAD$1.3 billion for one project.

Legal Disclaimer

Edoceo DEVICES, INC. Campaign

IMPORTANT NOTICE AND DISCLAIMER: All investments are subject to risk, which must be considered on an individual basis before making any investment decision. This is a paid advertisement to bring market awareness to Edoceo Devices, Inc., its products and services, and a related private equity investment opportunity under Regulation A+ of the JOBS Act. Edoceo hired Creative Direct Marketing Group, Inc (CDMG), an advertising agency, with a total budget of $150,000 to cover the costs associated with creating, printing media and distribution of this advertisement. . A related entity of the owners and management of CDMG purchased 300,000 shares of Edoceo common stock on August 19, 2019 at a price of $0.05 per share after learning about its technology. Neither CDMG nor the related entity or any other affiliated individual or entity has any present intention to buy or sell any shares of Edoceo now or in the near future and will not do so for a period of at least ninety (90) days following the date CDMG’s marketing efforts have ceased. This advertisement is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this advertisement, Edoceo or advertising agency’s copywriter purport to provide a complete analysis of any company or its financial position. CDMG is not, and does not purport to be, a broker-dealer or registered investment adviser. This advertisement is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC and/or other government filings. Investing in securities, particularly illiquid securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This advertisement contains forward-looking statements, including statements regarding Edoceo’s expected continual growth. Edoceo notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the company’s actual results of operations. Factors that could cause actual results to differ include the size and growth of the market for the company’s products and/or services, the company’s ability to fund its capital requirements in the near term and long term, pricing pressures, etc. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of this advertisement is made or implied. Neither Quara nor CDMG is affiliated, connected, or associated with, and are not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made to any rights in any third-party trademarks.